Let’sPlan meets everyone’s needs during the mortgage process.

Let’sPlan provides secure online software tools that streamline the mortgage loan officer workflow while also helping homebuyers determine their best loan options with ease. With the LP Loan Planner™ web app, mortgage loan officers can easily walk their customers through complicated loan variables, fees, and costs—ultimately leading to a more positive and transparent experience for everyone. Let’sPlan aims to make the home buying process easier for everyone and helps mortgage borrowers acquire the right loans for the right reasons.

Mortgage Loan Officers

Mortgage Loan Officers succeed by giving potential borrowers confidence that they are embarked on a fast, efficient process with a trustworthy advisor that will lead to the best loan outcome. With LP Loan Planner™, MLO’s can quickly find the right loan to fit their clients’ unique needs, which makes work more productive and satisfying.

Homebuyers

Searching for your ideal mortgage loan? LP Loan Planner™ makes the process easier, more transparent, and helps you make the best decision. Whether you prefer to work with your own mortgage loan officers or would like to get in touch with one of our expert consultants, LP Loan Planner™ will help you find your own best mortgage loan.

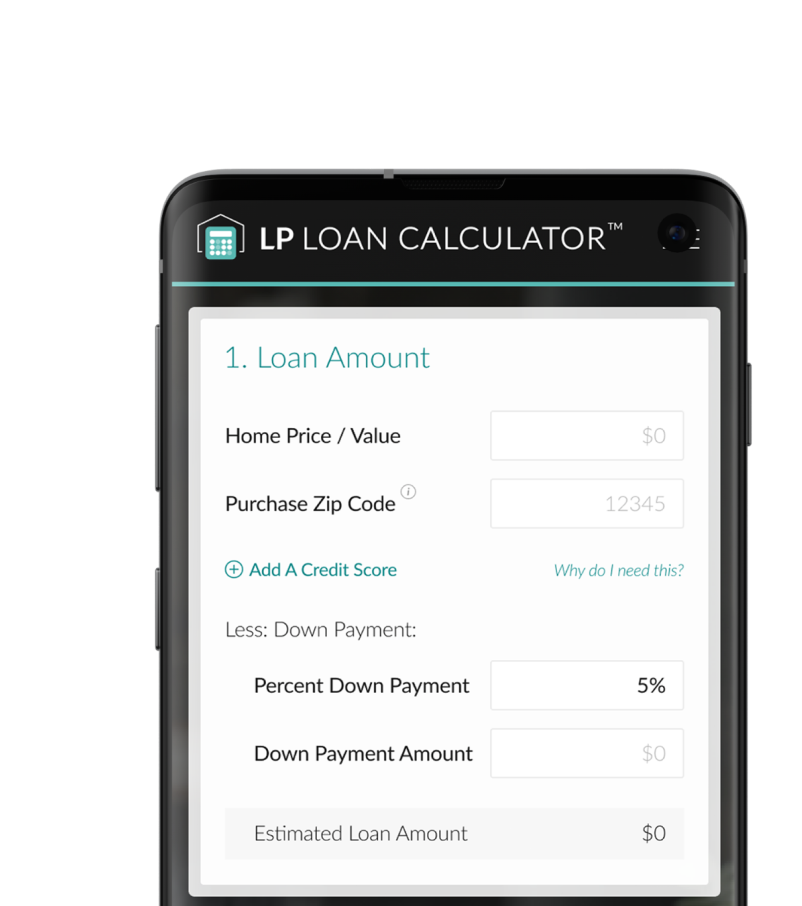

Announcing LP Loan Calculator™

The LP Loan Calculator™ web app helps homebuyers and loan officers get quick answers about down payments, cash at closing, and other essential loan information. Users can easily adjust numbers on the fly and calculate their monthly payments quickly, with the option to save their different loan scenarios. LP Loan Calculator™ is a convenient and powerful tool at every stage in the homebuying process.

The Let’sPlan story.

Steve Dellario created the first version of Let’sPlan in 2006 to help him translate banking into plain English, and help customers discover for themselves, with his help, the right mortgage for their needs.

Steve’s CPA training helps him see mortgages as major financial planning tools, and he builds loan applications around the real-world aspirations and resources of his customers. This approach works, and today Steve does about four times as much business as an average mortgage broker, and his capture rate, at over 80%, is also about four times the industry average.

Today’s Let’sPlan is the fifth major version, based on Steve’s great depth of experience using it with customers. He gets asked frequently to help other brokers improve their success rate and their job satisfaction, and Let’sPlan is his answer. He thinks that the process of getting a residential loan should be a positive and rewarding experience for both the customer and the broker, not a stressful experience that both parties feel compelled to endure.

He serves his customers, enjoys his work, and loves the life it affords him. He wants to help you feel the same way.

Founder of Let’sPlan